When It's Okay to Fire a Client: Dealing with Difficult and Disrespectful Clients

Introduction:

Working with clients is essential to your success as a business owner or professional. However, not all client relationships are smooth sailing. There are times when clients can become difficult to work with, and even worse, disrespectful to your employees. In such situations, the decision to fire a client can be difficult, but it's essential to consider the well-being of your team and the long-term success of your business. In this blog, we'll explore the circumstances under which it is okay to let go of a client who is causing harm to your company's morale and productivity.

The Impact on Employee Morale:

Disrespectful clients can have a significant impact on employee morale. Your employees are the backbone of your business, and their well-being directly affects the quality of the services or products you provide. Clients mistreating your team creates a toxic work environment, leading to decreased productivity, increased stress, and potential employee burnout. It is essential to recognize and address these issues promptly before they escalate.

The Cost of Difficult Clients:

Not all clients are profitable for your business. Some clients may demand excessive resources, frequent changes, or expect you to go beyond the scope of your services without compensating you accordingly. These difficult clients can drain your time and resources, reducing your ability to focus on more profitable and enjoyable projects. Understanding the actual cost of servicing such clients is crucial in making informed decisions about who you want to continue working with.

Maintaining Your Business's Reputation:

A business's reputation plays a significant role in its success. Clients who are disrespectful or difficult to work with may spread negative word-of-mouth about your company, potentially harming your brand image and deterring potential clients. Firing a problematic client demonstrates your commitment to maintaining high standards and prioritizing positive relationships with clients who value your services.

Professional Boundaries and Respect:

Establishing and maintaining professional boundaries is essential for a healthy client-business relationship. Difficult clients who consistently cross these boundaries may be challenging to work with and may not be willing to change their behavior. It is crucial to foster an environment where respect is mutual between clients and your team. If a client repeatedly disregards these boundaries, it might be a sign that parting ways is the best course of action.

Exploring Alternatives Before Firing:

Before making the final decision to fire a client, consider exploring alternative solutions. Have an open and honest conversation with the client, expressing your concerns about their behavior and its impact on your team. Sometimes, a simple conversation can lead to a resolution and a chance for the client to improve their conduct. However, if the behavior continues despite your efforts, it may be time to end the relationship.

Conclusion:

While it's often a challenging decision to let go of a client, sometimes it becomes necessary for the well-being of your employees and the long-term success of your business. Disrespectful and difficult clients can harm your company's morale, reputation, and financial stability. As a business owner or professional, it's essential to prioritize your team's welfare and maintain a positive working environment. By understanding the impact of difficult clients and establishing healthy boundaries, you can confidently make the right decision when it's time to fire a client. Remember, fostering a respectful and harmonious work environment will attract clients who appreciate your services and contribute to your business's growth. www.mcmginc.com

The Essential Pursuit of Work-Life Balance: A Blueprint for Thriving Employees

The line between work and personal life is becoming increasingly blurred in today's fast-paced and competitive world. Employees often face a relentless cycle of demanding work schedules, deadlines, and constant connectivity. In this pursuit of success, one crucial aspect often overlooked is the work-life balance. Today, we will explore the importance of work-life balance for employees and shed light on the numerous benefits it brings to both individuals and organizations.

Defining Work-Life Balance

Work-life balance refers to the equilibrium between an individual's professional commitments and personal life, ensuring they have adequate time and energy for personal fulfillment and well-being. It's about striking a harmonious integration between work, family, leisure, and personal development. When this balance is achieved, it can lead to increased job satisfaction, improved mental and physical health, and enhanced productivity.

The Impact of Work-Life Imbalance

Burnout and Stress: An imbalance between work and personal life often leads to chronic stress and burnout. When employees constantly feel overwhelmed by their professional responsibilities, their overall well-being suffers, and they become prone to physical and mental health issues.

Decreased Productivity: Paradoxically, overworking can result in reduced productivity. Without adequate time for rest and rejuvenation, employees' focus and efficiency decline, leading to lower-quality output.

Strained Relationships: Neglecting personal life can strain relationships with family and friends. When employees are unable to spend quality time with loved ones, it can create tension and dissatisfaction in personal relationships.

High Turnover Rates: Companies that don't prioritize work-life balance often experience higher turnover rates. Employees are more likely to seek opportunities elsewhere if they feel their well-being and personal lives are not being respected.

The Benefits of Work-Life Balance

Improved Mental Health: Achieving work-life balance allows employees to manage stress effectively, leading to better mental health and reduced risk of burnout, anxiety, and depression.

Enhanced Productivity: When employees have time to recharge and pursue personal interests, they return to work more motivated, focused, and productive.

Higher Job Satisfaction: A healthy balance between work and personal life fosters a sense of contentment and satisfaction in employees. They feel valued as individuals, leading to greater loyalty to the organization.

Better Physical Health: Balancing work and personal life often results in improved physical health, as employees can allocate time for exercise, healthy eating, and regular medical check-ups.

Increased Creativity and Innovation: Time spent away from work allows individuals to explore hobbies and interests, stimulating creativity and bringing fresh perspectives to the workplace.

Creating a Work-Life Balance

Set Boundaries: Establish clear boundaries between work and personal life. Avoid taking work-related calls or emails during personal time.

Prioritize Tasks: Focus on essential tasks and prioritize effectively to avoid unnecessary stress and over-commitment.

Utilize Flexible Work Options: Embrace flexible work arrangements, such as remote work or flexible hours, to accommodate personal needs.

Take Breaks: Encourage regular breaks during work hours to recharge and maintain productivity.

Promote a Supportive Culture: Organizations should foster a culture that values work-life balance and supports employees' well-being.

Conclusion

The pursuit of work-life balance is not merely a luxury but a necessity for both employees and organizations. A balanced approach to work and personal life can lead to improved mental and physical health, increased productivity, and higher job satisfaction. Employers and employees must work together to create an environment that encourages work-life balance, as it is an essential ingredient for success, happiness, and overall well-being. www.mcmginc.com

Unleashing the Power of Human Capital Management for Enhanced Employee Retention

Introduction

In today's fast-paced business landscape, attracting and retaining talented employees has become a top priority for organizations. As the job market becomes increasingly competitive, companies need to adapt and find innovative ways to keep their workforce engaged and satisfied. One powerful solution that has been gaining traction in recent years is the implementation of a robust Human Capital Management (HCM) system. In this blog post, we'll delve into the correlation between employee retention and HCM and explore how this dynamic duo can lead to a more successful and thriving workplace.

Understanding Human Capital Management (HCM)

Before we dive into the connection, let's take a moment to understand what Human Capital Management is all about. HCM encompasses a set of integrated processes and tools that help manage and nurture an organization's most valuable asset: its people. It goes beyond traditional HR practices and includes talent acquisition, onboarding, performance management, training and development, and more.

The Link Between HCM and Employee Retention

Streamlined Processes: A well-implemented HCM system can streamline various HR processes, reducing paperwork, and eliminating repetitive tasks. By automating routine procedures, HR professionals can focus on more strategic initiatives, such as developing employee engagement programs and career growth opportunities. When employees see that their workplace embraces efficiency, it fosters a positive environment that encourages them to stay committed to the organization.

Empowering Employee Development: HCM systems offer tools for employee training and development. When employees have access to continuous learning opportunities, they feel valued and invested in their professional growth. This, in turn, enhances their job satisfaction and reduces the likelihood of seeking opportunities elsewhere.

Data-Driven Decision Making: HCM systems generate valuable data and insights related to employee performance, satisfaction, and overall engagement. By leveraging this data, organizations can make informed decisions to address potential issues proactively and create targeted retention strategies that cater to their employees' needs.

Employee Feedback and Recognition: Regular feedback and recognition play a vital role in fostering a positive work environment. HCM platforms often include features for performance evaluations and employee feedback, making it easier for managers to recognize and reward top-performing employees. Feeling appreciated and acknowledged increases employees' sense of belonging and loyalty to the company.

Real-World Results

Companies that have embraced HCM and made it an integral part of their talent management strategy have witnessed tangible benefits. These organizations experience lower turnover rates, higher employee satisfaction scores, and increased productivity. As employees feel more supported, engaged, and aligned with the company's values and objectives, they are more likely to stay committed for the long term.

Conclusion

In conclusion, the correlation between employee retention and Human Capital Management is undeniable. Implementing an effective HCM system can significantly impact an organization's ability to attract and retain top talent. By streamlining processes, empowering employee development, and leveraging data-driven insights, companies can create an environment where employees thrive, leading to increased productivity, reduced turnover, and overall success.

To stay competitive in today's business landscape, organizations must prioritize their employees' needs and invest in their growth and development. Embracing Human Capital Management is not just an HR initiative; it's a strategic move that can transform a company's culture and drive it towards long-term prosperity. So, if you haven't already, it's time to unlock the power of HCM and unlock the full potential of your workforce. www.mcmginc.com

Celebrating Disability Month

🌍🤝 Celebrating Disability Month: Embracing Inclusion and Workforce Diversity! 🙌✨

Did you know that Disability Month has a remarkable history? 📚✨ It's a time dedicated to recognizing and honoring the invaluable contributions of individuals with disabilities throughout history. Let's dive into the journey and importance of this incredible month! 🌟

✨ Journey of Disability Month: Disability Month traces its roots back to the early 1940s when a small group of disability advocates envisioned a world that embraces diversity and equal opportunities for all. Their passion and dedication led to the establishment of a month-long celebration to shed light on the rights, achievements, and challenges faced by individuals with disabilities. Since then, Disability Month has evolved into a powerful movement advocating for inclusivity and accessibility worldwide. 🌍🌈

✨ The Power of Inclusion: Inclusion is the foundation of a truly harmonious society. When we embrace diversity, including individuals with disabilities, we unlock a wealth of talents, perspectives, and experiences that enrich our communities and workplaces. By fostering an inclusive environment, we create opportunities for everyone to thrive and contribute their unique strengths. Together, we can build a world where each person is valued, respected, and empowered to reach their full potential. 🤝💪

✨ Workforce Diversity: Workforce diversity is not just about meeting quotas—it's about building stronger, more innovative teams. Including individuals with disabilities in the workforce brings forth a wealth of untapped talent, creativity, and problem-solving skills. By removing barriers and providing reasonable accommodations, businesses can unlock the full potential of their workforce and create a culture of inclusion that benefits everyone. Let's celebrate the remarkable contributions made by individuals with disabilities in various industries and advocate for equal employment opportunities. 🚀💼

🌟 Join the Movement: During this Disability Month, let's come together to raise awareness, challenge biases, and build a world where inclusion and diversity are celebrated every day. Together, we can create change and foster a society where every individual is embraced for who they are. Share your stories, support organizations that champion disability rights, and let's work hand in hand to create an inclusive and accessible future. 🌈💙

🔁 Spread the Word: Help us reach more people by sharing this post and using the hashtag #DisabilityMonth. Together, let's inspire others, break down barriers, and celebrate the beauty of diversity and inclusion! 🌍✨ www.mcmginc.com

#DisabilityMonth #InclusionMatters #DiversityandInclusion #EmbraceDifferences #AccessibilityMatters #Empowerment

Impact of Employee Morale on Profitability

📣🌟 Boosting Employee Morale: The Secret Ingredient for Enhanced Profitability! 🌟📣

At Mutual Choice Management Group Inc, we believe in the power of a motivated and engaged workforce. Today, we want to shed light on how employee morale can directly impact our profitability and overall success. 💪💼

1️⃣ Happy Employees, Productive Workplace: When our team members feel valued and appreciated, their enthusiasm and dedication skyrocket! This positive energy translates into increased productivity, better collaboration, and higher quality outputs. It's a win-win for everyone! 🚀✨

2️⃣ Retention & Talent Magnet: A workplace with high employee morale becomes a magnet for top talent. Word travels fast, and when professionals know they'll be joining a supportive and uplifting environment, they'll be eager to be part of our team. Strong retention rates and attracting exceptional talent go hand in hand. 🌟🔥

3️⃣ Enhanced Customer Experience: Happy employees create happy customers! When our team members are satisfied and engaged, they deliver exceptional service, go the extra mile, and build lasting relationships with clients. This positive customer experience directly impacts our bottom line, fostering customer loyalty and driving revenue growth. 💼💙

4️⃣ Innovation & Creativity: Employee morale fuels creativity and innovation. When individuals feel valued and empowered, they are more likely to think outside the box, propose fresh ideas, and drive positive change within the organization. By fostering a culture of high morale, we unlock our team's full potential and stay ahead in a competitive market. 🚀💡

5️⃣ Healthier Work Environment: A positive work atmosphere not only boosts morale but also contributes to better mental and physical well-being. When our team members are happy, stress levels decrease, job satisfaction increases, and overall health improves. A healthier workforce means reduced absenteeism, increased focus, and improved overall productivity. 💪💚

Let's continue to prioritize employee morale as a key driver of our profitability. By investing in our team's well-being, we are investing in the sustainable growth and success of Mutual Choice Management Group Inc. Together, we can achieve extraordinary results! 🌟🌈 www.mcmginc.com

#EmployeeMorale #Productivity #Profitability #WorkplaceCulture #Success #Teamwork

How Impactful is Employee Morale in the Workplace?

Attention all employees! 🌟

Let's take a moment to discuss the incredible power of employee morale in our workplace. 🤝✨

Did you know that the happiness and enthusiasm we bring to our jobs can have a profound impact on our productivity, success, and overall well-being? It's true! 😊💼

Here are a few reasons why employee morale is essential:

1️⃣ Boosts productivity: When we're motivated and engaged, we accomplish tasks more efficiently and with greater focus. A positive work environment encourages creativity, problem-solving, and collaboration, leading to remarkable results.

2️⃣ Enhances teamwork: High morale promotes a sense of unity and camaraderie among colleagues. When we feel valued and supported, we're more likely to communicate effectively, share ideas, and work together seamlessly as a team.

3️⃣ Increases job satisfaction: When we enjoy coming to work, it creates a sense of fulfillment and purpose. Positive morale fuels job satisfaction, leading to higher retention rates and decreased stress levels among employees.

4️⃣ Fosters innovation: A supportive work culture encourages employees to think outside the box and take risks. With high morale, we feel empowered to share innovative ideas and contribute to the growth and success of our organization.

5️⃣ Improves customer experience: Happy employees create happy customers! When we're genuinely enthusiastic about our work, it shines through in the way we interact with clients and customers. Positive experiences build loyalty and promote business growth.

Let's remember that each of us plays a crucial role in shaping our work environment. Together, we can cultivate a positive atmosphere that fuels our motivation, enhances our well-being, and propels us toward success. 💪🌈

So, let's celebrate each other's achievements, lift each other up, and always strive to create a workplace where everyone feels valued, respected, and appreciated. Together, we'll achieve extraordinary things! 🎉🙌 www.mcmginc.com

#EmployeeMoraleMatters #PositiveWorkEnvironment #TeamworkMakesTheDreamWork

ASO vs PEO: Which is best for your organization?

ASO and PEO are two distinct business models related to HR (Human Resources) and employee management. Let's understand the difference between them:

ASO (Administrative Services Organization): ASO stands for Administrative Services Organization. It is a service provider that assists businesses in managing various administrative functions related to human resources. An ASO typically handles tasks; such as payroll processing, benefits administration, tax filings, and workers' compensation management. It essentially acts as an outsourced HR department, helping companies navigate administrative complexities. However, the business retains control over strategic HR decisions and employee policies.

PEO (Professional Employer Organization): PEO stands for Professional Employer Organization. It is also a service provider that offers comprehensive HR solutions to businesses. In addition to administrative functions, PEOs provide HR consulting, employee training, risk management, and compliance assistance. One key distinction of a PEO is that it enters into a co-employment relationship with the client company, which means that the PEO becomes the employer of record for the employees, handling payroll, benefits, and legal responsibilities. The PEO and the business share some employer responsibilities, with the PEO assuming a more significant role in day-to-day HR functions.

In summary, the main difference between ASO and PEO lies in the level of involvement and responsibility by either service provider. ASOs primarily handle administrative HR tasks while allowing the client company to retain control over strategic decisions. On the other hand, PEOs take on a broader HR role, entering into a co-employment relationship and sharing employer responsibilities with the client company.

So, which one is best for your organization?

The choice between ASO and PEO depends on the specific needs and preferences of the organization. There is no definitive answer as to which one is best since it varies based on factors such as the size of the organization, its HR requirements, and its long-term goals. Here are a few considerations to help you make a decision:

ASO might be the best option if:

The organization wants to retain control over strategic HR decisions, such as hiring, firing, and employee policies.

The organization has the internal resources and expertise to handle day-to-day HR tasks but requires assistance with administrative functions like payroll processing and benefits administration.

The organization prefers a more hands-on approach to HR and wants to maintain direct relationships with employees.

PEO might be the best option if:

The organization wants to offload most HR functions and focus on core business activities.

The organization is searching for comprehensive HR services, including payroll, benefits, compliance, risk management, and employee training.

The organization wants to leverage the expertise and resources of a PEO to enhance HR practices and employee satisfaction.

The organization is open to a co-employment arrangement and comfortable sharing employer responsibilities with the PEO.

It's crucial to thoroughly assess your organization's needs, evaluate the available options, and consider consulting HR professionals or experts to determine the most suitable choice for your specific circumstances. www.mcmginc.com

Why Small Businesses should offer Dental and Vision insurance plans to their employees benefits package.

Providing supplemental insurance like dental and vision benefits packages can help employees stay healthier longer. Good dental health promotes a better quality of life and can help prevent oral disease. A routine eye exam can detect the early onset of diseases such as high blood pressure, diabetes, and some forms of cancer. Providing supplemental insurance can increase employee retention and loyalty. With dental and vision insurance access, your employees can enjoy better overall health and save money on their healthcare.

Health insurance is beneficial for your business, too. Enrolling in SHOP allows you to take advantage of the Small Business Health Care Tax Credit, in which the government may reimburse you for up to 50% of the costs you pay toward your employees’ premiums. Your small business qualifies for the tax credit if it:

Fewer than 25 employees are working full-time or at full-time equivalent.

Has an average employee salary of $56,000 or less.

Pays at least 50% of full-time employees’ health insurance premiums.

Offers SHOP coverage to full-time employees.

SHOP plans may not be offered in every county and zip code. Click here to discuss your benefit options for your employees. www.mcmginc.com

What is Pay as You Go Workers Comp?

The pay-as-you-go method allows you to pay your workers’ compensation premiums based on your actual payroll and exposure risk, instead of the budgeted payroll you believe will be accurate for the year. This helps eliminate surprises during your workers’ comp audit. These surprises can include additional premiums owed. Example: Let’s say that your expected 2023 payroll is $200,000. Your annual workers’ compensation insurance policy premium will be based on your $200,000 payroll. During the year you may have experienced some growth and/or rewarded a few employees with promotions. This fortunate situation increased your 2023 payroll to $500,000. You will now owe an additional premium on the difference ($300,000) to the insurance carrier for the year. Pay as You Go Workers Comp will eliminate this possibility that your company would otherwise have with traditional workers’ compensation insurance.

What are some of the benefits of Pay-As-You-Go Workers’ Compensation Insurance?

Ultimately the decision to choose between going the pay-as-you-go alternative route or the traditional lump sum payment route comes down to which method works best for your company. Here is why pay-as-you-go is a good alternative for many business owners.

Large annual lump sum payments can deteriorate your business budget and eat into your business cash flow.

Calculating your workers’ comp can be difficult to predict. Pay-as-you-go calculates your rate each payroll cycle. Traditional workers comp premiums are based only on estimates. With Traditional workers’ compensation, you have to project what your payroll will be for the year.

Pay-as-you-go premiums are based on your actual payroll. This ensures that you pay an accurate premium. This method will prevent your business from over or underestimating your premium amounts. This will simplify the auditing process.

Using pay-as-you-go prevents you from forgetting to pay your premium. Your provider will automatically collect your premium each payroll. www.mcmginc.com

What should I consider when looking for a health plan?

Buying health insurance as an individual, family, or small business now can seem daunting at first, but it doesn’t need to be complicated. There are some certain things you want to look for, of course. Price is always a factor, and that can often be hard to gauge.

It really comes down to how much you want to pay. How much can you afford to pay each month? Like car insurance, the more money you pay monthly, the more financial coverage you’ll have should unforeseen expenses arise.

Far too often, consumers will only look at the monthly premium when determining the right health insurance for them. The monthly cost should definitely be a factor, but focusing on only price can cause grief and end up costing you more in the long run. So what else should you consider when shopping for health insurance?

With that being said, here is some basic, but essential information you’ll want to consider when you buy health insurance:

Premium

This is the total cost of the health insurance plan you as the consumer will pay either monthly or in full. How much you pay depends on the benefits which are included in the plan. Please note: this amount is separate from the deductible.

To keep the cost low, there are some factors which you can control in order to save money: your deductible, copay and coinsurance amounts.

The Infamous Deductible

The Deductible is a set dollar amount that a policyholder needs to pay before the insurance will pay for most services. This is the total amount which you as the consumer need to first pay toward any medical expenses you receive during your coverage period. Covered medical expenses after this amount will be paid by the health insurance company in accordance with the policy (e.g. you may still be subject to copays and coinsurance).

For example: if your deductible is $1000 and you have a $3,000 hospital bill, you would pay $1,000 and the health insurance company would pay most of the remaining $2,000 (you may be subject to coinsurance up to the policy’s max out of pocket amount). Generally speaking, the higher the deductible, the lower the premium.

Higher deductible plans are especially beneficial for those who seldom visit the doctor or purchase prescription medication. If you’re not going to use it, why pay more for it? Even with a high deductible plan, you’ll still be covered in case of an emergency. Although you will still need to pay the amount of the deductible, it’s still cheaper than the cost of most emergency procedures. High deductible plans are a great option for those who are in good health.

On the other hand, people who do have a lot of medical expenses (such as surgeries) would save more money by opting for a lower deductible plan.

Copay

This is the cost which the consumer pays on top of the premium each time they go to a doctor or health specialist. Co-pays also apply to Emergency Room visits, urgent care visits and prescription drug purchases.

Please note: the co-pay (or co-payments) are not applied towards your deductible, and will remain your financial responsibility even after meeting your deductible.

Your copay costs will depend on how much you pay monthly for your health insurance policy. In general, the higher the premium, the lower the copay. Conversely, lower premiums will typically have higher co-pays. So if you take prescription medication or require frequent doctor appointments, it would be wise to invest in a lower copay plan.

Coinsurance

This is the percentage of a medical bill that you’re responsible for paying after the insurance company pays their part. The amount that the health insurance company pays will vary based on your benefits and is only done once you have met your deductible.

Please note: coinsurance is paid on top of the copay.

The money you pay with each office visit is applied to your deductible. Once you have paid the total amount (aka meeting the deductible), you are still responsible for the coinsurance.

For example: if you have a medical bill of $1,000 and a deductible of $5,000 - the amount you actually owe will depend on three questions:

Have you met your deductible?

What is your coinsurance percentage?

What is your max out of pocket?

If you haven’t met your deductible, you’ll owe $1000 (which will be applied toward your deductible). If you have met your deductible, you’ll owe a percentage of the bill (your coinsurance). So if your coinsurance is 20%, you would pay $200 and the insurance company would pay the remaining $800.

Once you meet the max out of pocket (for example, $5,100) he health insurance company will cover the rest of your medical bills for the length of the policy. It is always wise to know exactly what services and conditions your health insurance plan covers, though, as it can vary greatly from policy to policy.

Which of these factors are most important to you in a health care policy?

Provider Network

We have all been there. You or your child gets sick, and you go to your preferred doctor only to find out that your insurance policy isn’t accepted there. At that point, you either have to pay out of pocket and hope your policy has a good out-of-network benefit, or go searching for a new, unfamiliar doctor. The provider network is always available and up to date online.

Check to see if your providers and hospitals are covered. Some short-term health insurance plans have no network, meaning that insurance will pay a sum based on the service provided at nearly all providers. In that case, it’s best to check with your insurance to see what they will cover, and confirm with your provider that their pricing is in line with what the insurance will pay.

Pharmaceutical Coverage

If you take medication, check to see if your medications are covered, if you will be required to buy the generic, and what the copay on your medications will be. If you have not researched this, there could be a problem. A medication covered on your old insurance plan that cost only a few dollars now could easily cost over $100.

Dental

Most dental procedures aren’t covered by health insurance. These procedures can be costly, but premiums for dental insurance can be very low. It’s a good idea to buy dental insurance when you buy your health insurance. Get a quote now.

What Insurance is Best for You?

Not all insurance is built equally, and what may work for you might not work for your neighbor. Assess your medical needs and health situation before shopping for insurance. Some people may require a platinum-tier Obamacare plan because they are constantly in and out of the doctor’s office or hospital, while some people may just want the reassurance that a Hospital Indemnity Insurance Plan offers--it includes limited benefits like a fixed -indemnity payment to you if you need medical services due to an accident or illness, and may be bundled with lifestyle benefits like prescription discounts and telemedicine. By spending a little time determining your needs, you may save yourself thousands of dollars.

Choose Wisely

There’s no right plan for everyone, which is why there are so many health insurance options on the market. If you have a history of being healthy, and you are comfortable going without some of the 10 essential benefits of Obamacare (maternity, mental health) then a short-term health plan may be a good health insurance option. If you prefer a more robust plan with all 10 benefits, then an Obamacare plan is a better choice. It is recommended that you compare health insurance plan benefits to find the one that best fits your needs. www.mcmginc.com

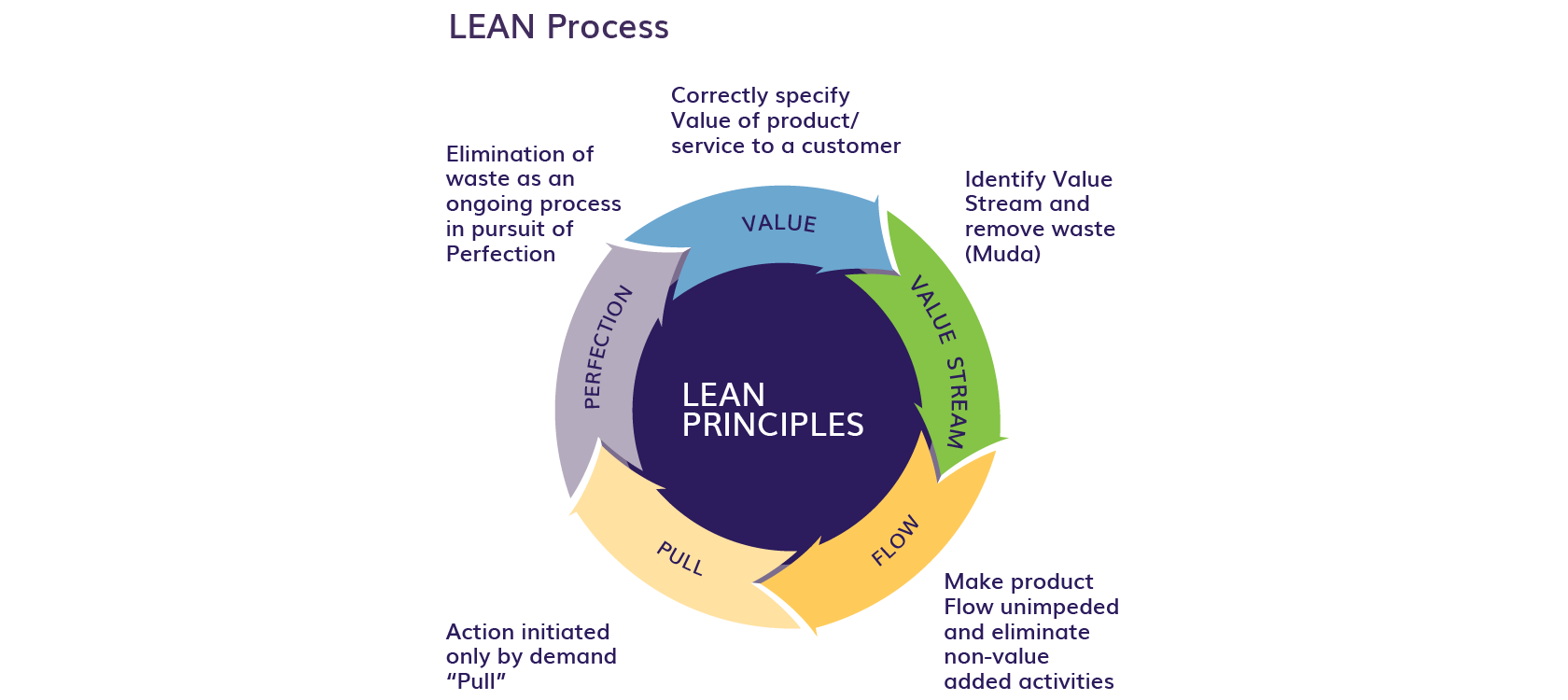

How do you choose a Process Improvement Consultant?

Almost every successful business understands how effective streamlining and continually improving their business processes can be. A company that continues to improve and reach perfection will have a positive impact on their bottom line. Your business will operate more efficiently and leaner. Creating a culture of continuous improvement in an ever-changing market will take time and require specialized expertise. More organizations are placing focus on their internal processes instead of focusing only on employee output and sales. Improving your process is not easy, and you may need outside help, but how do you choose a process improvement consultant for your business?

Here are a few things to take into consideration when searching for a process improvement consultant.

How much will a process consultant cost you?

Will you have a positive ROI (Return on Investment)?

What impact will a process improvement consultant have on the business ROI?

Is the process improvement consultant competent?

It is best to choose your process consultant based on the value she will add and how they will impact your ROI. You do not want to base your choice solely on cost. If you make this decision, you could find yourself firing a consultant and hiring another. If possible, select a process improvement consultant that charges a fixed rate instead of an hourly rate. This decision will ensure a couple of things. 1) You will know your cost before the project starts. 2) The process improvement consultant will be taking on some of the risks by electing to charge a fixed rate. The second point will limit some of your risks.

Your company will have to decide if it will hire a single consultant or an entire firm. Note: hiring a firm will not come cheap but will be easier to get approved by a C-Level suite member. Once you make your decision, you should request an estimated return on investment. Understand that the consultant will be onsite for weeks before you begin to results on ROI. However, during this time, you will see an increase in employee morale and customer satisfaction. These improvements will increase productivity and repeat customers respectfully.

Your process improvement consultant should be competent in your industry (not required) and suitable for your business. If you fail to find a consultant that is competent in your industry, do not fret. Currently have employees that will assist the consultant with the details of your organization and industry. Additionally, when considering a process improvement consultant you should expect them to contribute to your business as if they're an employee.

You want to hire a process improvement consultant that is suitable for your organization. All process improvement consultants should be compatible with your organization. One size fits all will not work here. The consultant you choose should fit in easily with your organization's culture. Adaptability will play a pivotal role in the precision of the ROI you will receive from the process improvement consultant's recommendations. The consultant you hire should be flexible. They will have the ability to adjust their methods to improve the targeted processes within your organization. He/she should not feel that their methods work 100% of the time. What works for one organization may not work for another.

Often overlooked are soft skills. It is crucial that the process improvement consultant communicates well with you and your employees. If the process improvement consultant lacks any soft skills you will run the risk of your employee's morale becoming negatively impacted. Focus less and never base your hiring decision only on technical skills. You want an educator that will teach your employees, which will allow them to continue to use the skills and tools acquired from the process improvement consultant long after he/she completes the project.

Every successful process improvement consultant should have a proven track record that displays the company's state before recommendations and after. www.mcmginc.com

Why hire a PEO company?

Why use a PEO (Professional Employer Organization)?

By providing payroll, benefits, and HR services and assisting with compliance issues under state and federal law, PEOs allow small businesses to improve productivity and profitability, focus on their core mission, and grow.

According to a recent study by noted economists Laurie Bassi and Dan McMurrer, small businesses that use PEOs grow 7 to 9 percent faster, have 10 to 14 percent lower employee turnover and, are 50 percent less likely to go out of business.

Through a PEO, the employees of small businesses gain access to big-business employee benefits such as 401(k) plans; health, dental, life, and other insurance; dependent care; and other benefits they might not typically receive as employees of a small company. Additionally, companies save money on worker’s compensation coverage. Generally, to begin a workers compensation policy with a PEO, no down payment is required and it is pay-as-you-go. If your company is interested in receiving a quote, please complete the below form.

We are a PEO Broker, which means that we work for you. We will find the PEO that is the best fit for your company's needs and culture. Additionally, we will partner your company with the most cost-effective PEO. Our goal is to ensure that you receive superior services, bottom-line savings, and modern tech capabilities such as apps and automated processes to allow you more time to manage your business operations.

It is always a wise idea to get an updated PEO quote if you already have a PEO or if it is the first time that you are considering hiring a PEO. For example, we recently acquired a new client. Our new client is a regional HVAC company that was partnered with a PEO prior to our meeting. They allowed us to run a quote, which we will quote through several different PEO’s. When we presented the quote we were able to save the business over $100,000 annually. Higher profit margins are the ultimate goal right?!

We ask that you enter your information below and allow us to run a quote and see if we can save you some money and provide better service. www.mcmginc.com

What is Medigap?

Medigap is a medicare supplement that is used to pay your healthcare cost that Original Medicare will not cover. You can enroll in a Medigap plan at any time once you reach age 65. However, it is best to enroll in your 6 month enrollment period. During this period you will not have to go through medical underwriting. Your enrollment period will begin the first day of the month you turn 65 and enrolled in Part B.

If you apply for Medigap coverage after your open enrollment period, there's no guarantee that an insurance company will sell you a Medigap policy if you don’t meet the medical underwriting requirements, unless you're eligible due to one of the situations below.

In some states, you may be able to buy another type of Medigap policy called Medicare SELECT. If you buy a Medicare SELECT policy, you have the right to change your mind within 12 months and switch to a standard Medigap policy.

Please review your situation below.

I’m 65 or older:

Your Medigap open enrollment period begins when you enroll in Part B and can't be changed or repeated. In most cases, it makes sense to enroll in Part B when you're first eligible because you might otherwise have to pay a Part B late enrollment penalty.

I’m turning 65:

The best time to buy a Medigap policy is the 6-month period that starts the first day of the month you're 65 or older and enrolled in Part B. For example, if you turn 65 and are enrolled in Part B in June, the best time for you to buy a Medigap policy is from June to November.

After this enrollment period, your option to buy a Medigap policy may be limited and it may cost more. Some states have additional open enrollment periods.

I’m under 65:

Federal law doesn't require insurance companies to sell Medigap policies to people under 65. If you're under 65, you might not be able to buy the Medigap policy you want, or any Medigap policy, until you turn 65. However, some states require Medigap insurance companies to sell you a Medigap policy, even if you're under 65. If you're able to buy one, it may cost you more.

I have group coverage with my employer or union:

If you have group health coverage through an employer or union because either you or your spouse is currently working, you may want to wait to enroll in Part B. Employer plans often provide coverage similar to Medigap, so you don't need a Medigap policy.

When your employer coverage ends, you'll get a chance to enroll in Part B without a late enrollment penalty. That means your Medigap open enrollment period will start when you're ready to take advantage of it. If you enrolled in Part B while you still had employer coverage, your Medigap open enrollment period would start. Unless you bought a Medigap policy before you needed it, you’d miss your open enrollment period entirely.www.mcmginc.com

Please visit www.medicare.gov for more information. If you have any questions please send an email to info@mcmginc.com

Missed open enrollment?

It all begins with an idea.

For most, the enrollment period for your employer's health benefits has ended. If you missed this enrollment period and in need of health coverage, we can help.

We can customize a health plan that will cover you and your family until your employer's open enrollment begins next fall.

If you're in need of health coverage please click the orange link below or visit www.mcmginc.com to schedule a consultation.